Unemployment Lifeline: What You Need to Know to Stay Afloat

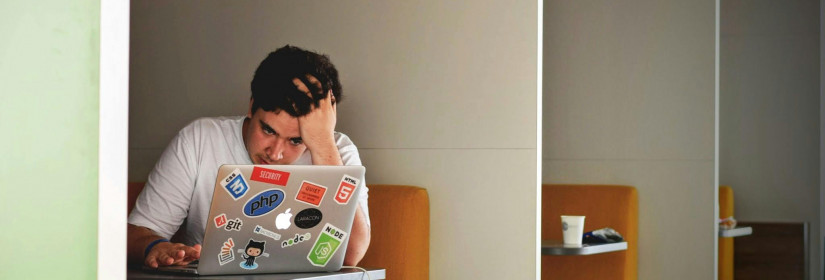

Losing a job is one of life's most stressful events, causing emotional and financial upheaval.

The immediate loss of income and the uncertainty of finding new employment can create a crisis. However, unemployment insurance provides a lifeline during these challenging times.

This article delves into what you need to know to stay afloat when facing unemployment.

Understanding Unemployment Insurance

Unemployment insurance is a state-administered program that offers temporary financial assistance to workers who have lost their jobs through no fault.

Funded by employer taxes, the program aims to help individuals cover essential expenses while they search for new employment.

The benefits typically include a percentage of the individual's previous earnings for a set period, with variations from state to state.

Understanding how unemployment insurance works is crucial for leveraging its benefits effectively.

Each state has specific eligibility requirements and application processes, so becoming familiar with your state’s regulations can help you navigate the system more efficiently.

How to Apply and Qualify

Applying for unemployment insurance can be straightforward if you follow these steps:

Step 1: Determine Eligibility

- Work History: Check if you have sufficient work history and earnings during the base period, which is usually the first four of the last five completed calendar quarters before you file your claim.

- Reason for Unemployment: Ensure you lost your job through no fault of your own (e.g., layoffs, company closures).

- State-Specific Criteria: Verify any additional requirements specific to your state, such as minimum earnings or employment duration.

Step 2: Gather Necessary Information

Prepare the following information to expedite your application:

- Personal Information: Social Security number, address, phone number, and email.

- Employment Details: Names, addresses, and contact information for all employers in the past 18 months.

- Dates of Employment: Start and end dates for each job.

- Reason for Job Loss: A detailed explanation of why you are no longer employed.

Step 3: File Your Claim

- Online Application: Most states offer online portals for filing unemployment claims. Visit your state’s unemployment insurance website to start your application.

- Phone Application: If you prefer, you can apply by phone. Check your state’s website for the appropriate phone number and operating hours.

- In-Person Application: Some states allow in-person applications at local unemployment offices.

Step 4: Submit Required Documentation

- Identity Verification: Provide proof of identity, such as a driver’s license or passport.

- Work Authorization: If you are not a U.S. citizen, submit proof of your work authorization (e.g., Green Card or work visa).

- Income Verification: Submit pay stubs or W-2 forms from your previous employers.

Step 5: Certify Weekly or Bi-Weekly

- Certification: Regularly certify your unemployment status online or by phone as required by your state (usually weekly or bi-weekly).

- Job Search Requirements: Report your job search activities, including job applications and interviews, to maintain eligibility for benefits.

Step 6: Monitor Your Claim

- Claim Status: Check the status of your claim through your state’s unemployment website or customer service line.

- Respond Promptly: Respond to any requests for additional information or documentation to avoid delays.

The Benefits of Unemployment Insurance

Unemployment insurance provides a range of benefits designed to support individuals and families during periods of joblessness. Here are some of the key benefits:

- Financial Assistance: Unemployment insurance offers temporary financial assistance, typically a percentage of your previous earnings, which helps cover essential expenses like rent, groceries, and utilities while you search for new employment.

- Health Coverage Continuation: Many states offer programs that help unemployed individuals maintain their health insurance coverage through programs like COBRA or Medicaid, ensuring that job loss doesn't result in a loss of medical care.

- Job Search Support: Unemployment insurance programs often include access to job search resources, career counseling, and training programs. These services can help you upgrade your skills, explore new career paths, and find job openings more quickly.

- Economic Stability: By providing a financial safety net, unemployment insurance helps stabilize the economy during downturns. It ensures that unemployed individuals have some purchasing power, which supports local businesses and prevents more significant economic decline.

- Mental Health Support: Financial stress can take a toll on mental health. Unemployment insurance helps alleviate some of this stress by providing a reliable source of income, allowing individuals to focus on finding new employment without the constant worry of financial instability.

- Understanding The Disconnect: Why The Job Market Feels Tougher Than Ever

- Finding Opportunity In A Shifting Job Market

Conclusion

Navigating the complexities of unemployment insurance can be challenging, but it is a crucial resource for surviving job loss and maintaining financial stability.

By understanding the basics, applying correctly, and exploring additional benefits tailored to your situation, you can leverage this support to weather difficult times and transition to new employment opportunities.

Don't let job loss overwhelm you—empower yourself with knowledge and take control of your financial future with the hidden benefits of unemployment insurance.

Previous article: Surviving Job Loss: The Hidden Benefits Of Unemployment Insurance